Understanding how money works is more important now than ever before. As financial challenges grow more complex, today’s students must be equipped with knowledge that goes beyond basic arithmetic and budgeting. One key area often overlooked in early education is taxation. Knowing how the system works, how it impacts income, and what relief programs exist—such as the Fresh Start tax forgiveness initiative—can set the foundation for lifelong financial stability.

The Increasing Demand for Early Financial Education

Financial literacy is an aspect that people used to learn through trial and error. Unfortunately, this experiment results in expensive mistakes for most adults, particularly when it comes to taxes. They leave school, go to work, and are expected to know about tax brackets, deductions, W-2s, 1099s, and so on, with little or no formal education to help them.

Financial literacy is an aspect that people used to learn through trial and error. Unfortunately, this experiment results in expensive mistakes for most adults, particularly when it comes to taxes. They leave school, go to work, and are expected to know about tax brackets, deductions, W-2s, 1099s, and so on, with little or no formal education to help them.

Educating people about taxes early also eradicates the confusion and stress that people experience during the tax season. Knowing how income tax works and why it is essential, students are more likely to manage their income when they have to work part-time, do internships, or freelance work. This basic knowledge will minimize the chances of making tax-related errors, which will attract penalties and even incur debt in the long term.

Taxation in the Digital Age

The digital economy has radically transformed the income-earning and reporting. With social media influencers and online business opportunities like teen entrepreneurs, students are now entering into a taxable world at much younger ages than before. Although these new-age sources of income are helping people earn money, most young people are not even aware of the tax implications of these sources.

The digital economy has radically transformed the income-earning and reporting. With social media influencers and online business opportunities like teen entrepreneurs, students are now entering into a taxable world at much younger ages than before. Although these new-age sources of income are helping people earn money, most young people are not even aware of the tax implications of these sources.

As an example, even the money you earn by selling handmade items on Etsy or tutoring online has to be reported in many cases. These young earners may end up not reporting income correctly or at all, which can lead to problems later in life without education. Learning tax literacy in school makes students ready to face these realities and makes them eager to be responsible members of the digital economy.

Avoiding the Financial Mistakes Before They Happen

Lack of knowledge on taxes can lead to one getting into unnecessary debts. Failure to understand the withholding amounts or submit the filings on time can lead to significant financial costs. There are programs such as the Fresh Start tax forgiveness program that will help people overcome these problems, but the best course of action is to prevent these issues from occurring.

Lack of knowledge on taxes can lead to one getting into unnecessary debts. Failure to understand the withholding amounts or submit the filings on time can lead to significant financial costs. There are programs such as the Fresh Start tax forgiveness program that will help people overcome these problems, but the best course of action is to prevent these issues from occurring.

The development of this early awareness is the responsibility of educators and parents. There should be a discussion of income, savings, and taxes, made normal both at home and in the classroom. Explaining to the children the difference between their gross and net pay, and how taxes are used to support the services that they enjoy can make the topic less mysterious. It also promotes respect for the financial commitments rather than fear or avoidance.

Learning in the Real World to Succeed throughout Life

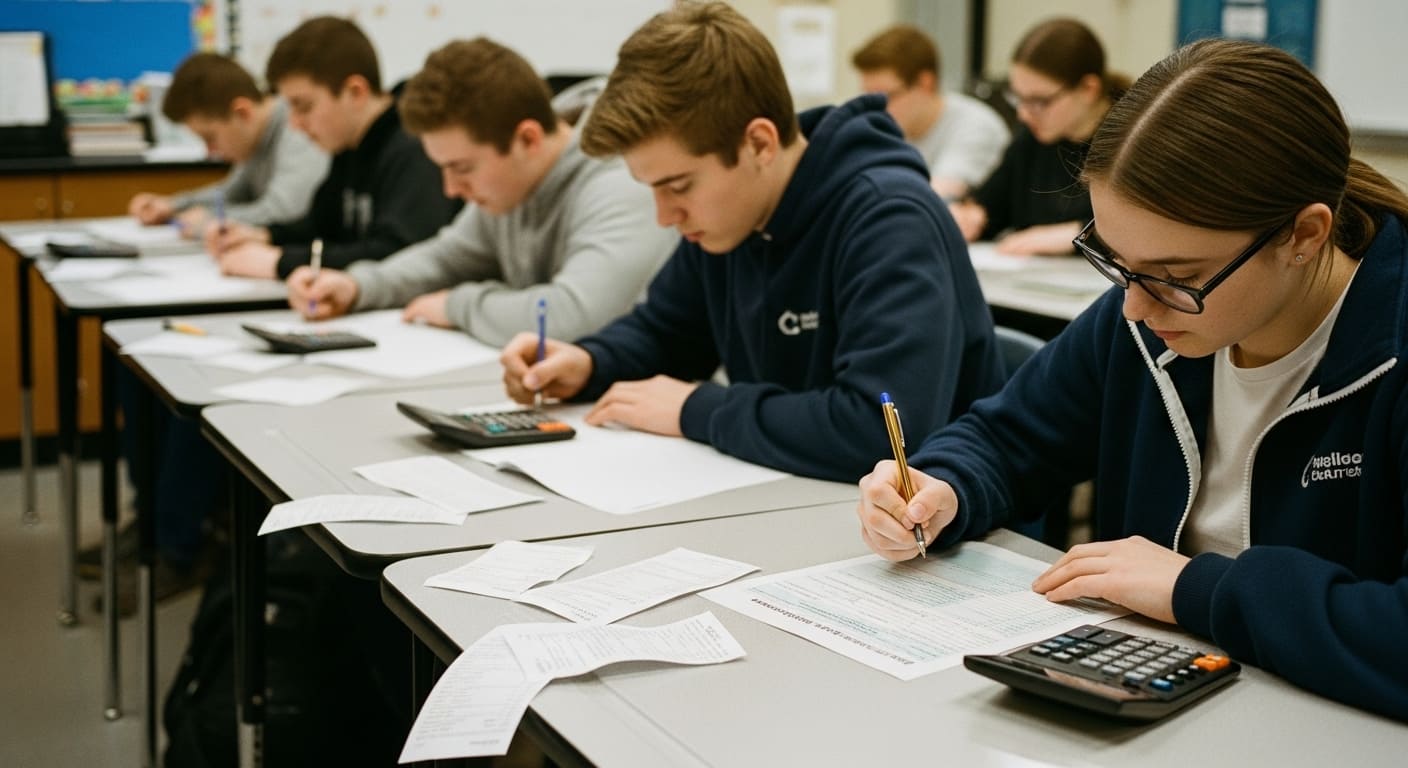

The use of real-life examples in financial education enables students to appreciate its practical applications. Simulations of paying taxes, interpreting pay stubs, or even computing deductions on made-up incomes can help bring abstract concepts into the real world. Such a form of experiential learning will equip students with the skills and knowledge needed to become adults, and they will also gain confidence in their ability to manage their money.

The use of real-life examples in financial education enables students to appreciate its practical applications. Simulations of paying taxes, interpreting pay stubs, or even computing deductions on made-up incomes can help bring abstract concepts into the real world. Such a form of experiential learning will equip students with the skills and knowledge needed to become adults, and they will also gain confidence in their ability to manage their money.

Furthermore, providing students with connections to actual resources, e.g., to online tax preparation tools or introductory guides, will make sure that students know what to resort to when the time comes. They must also be informed that there are legally friendly ways of solving tax, and some of these could be through the government-assisted programs. Such lessons enable them to be in charge instead of becoming overwhelmed by the necessity to deal with taxation.

The Role of Policy and Curriculum Developers

To influence the situation, tax literacy should become part of the national education system. The students need to be taught about civics and environmental responsibility, and so they should learn about the tax system as well. Curriculum designers can work with financial professionals, tax lawyers, and organizations to make the materials enjoyable, age-specific, and work.

To influence the situation, tax literacy should become part of the national education system. The students need to be taught about civics and environmental responsibility, and so they should learn about the tax system as well. Curriculum designers can work with financial professionals, tax lawyers, and organizations to make the materials enjoyable, age-specific, and work.

The local and federal education policies should also respect the fact that not just future accountants need to learn how to handle taxes – it is a life skill. The positive effects of early education extend to the community as they will have adults who are more responsible in their finances and can make informed choices, avoid unnecessary debt, and contribute better to the economy.

Conclusion

Literacy in finances is a passport to financial independence, and mastering taxes is an essential aspect of it. As students enter the workforce, start side-gigs, or otherwise get their lives together, they must have the means to ensure that they are aware of how to handle their tax affairs. Educating people about these concepts at an early age will help them avoid making the mistakes that land people in trouble and that caused Fresh Start tax forgiveness to be needed in the first place. Taxes are not something to teach later on in life, but now.