In today’s complex world, financial literacy isn’t just a “nice-to-have” skill – it’s a necessity. But how do you make abstract concepts like budgeting, saving, and investing engaging for students? Let’s be honest, discussing interest rates can sometimes feel as exciting as watching paint dry. Yet, these are the skills that will empower our students to navigate their future with confidence.

The answer might surprise you: Gimkit financial literacy games. You know Gimkit as a fast-paced, interactive learning game, but it’s so much more than just a quiz platform. With its intuitive in-game economy and diverse game modes, Gimkit transforms into a powerful, simulated economic environment. It becomes the perfect sandbox for students to experience financial principles firsthand, without the real-world risks.

This deep dive will explore how Gimkit’s core mechanics can be leveraged to teach budgeting with Gimkit, delve into Gimkit money management, and even introduce complex ideas like Gimkit investment games. Our goal? To make financial education practical, interactive, and truly memorable for your students, help them connect classroom concepts to their everyday lives.

The Gimkit Economy: A Playful Introduction to Personal Finance

Let’s discover why Gimkit is an excellent resource for financial education. Gimkit has its own money system. It works like the real world. It’s a great place to start.

How Gimkit’s In-Game Currency Works

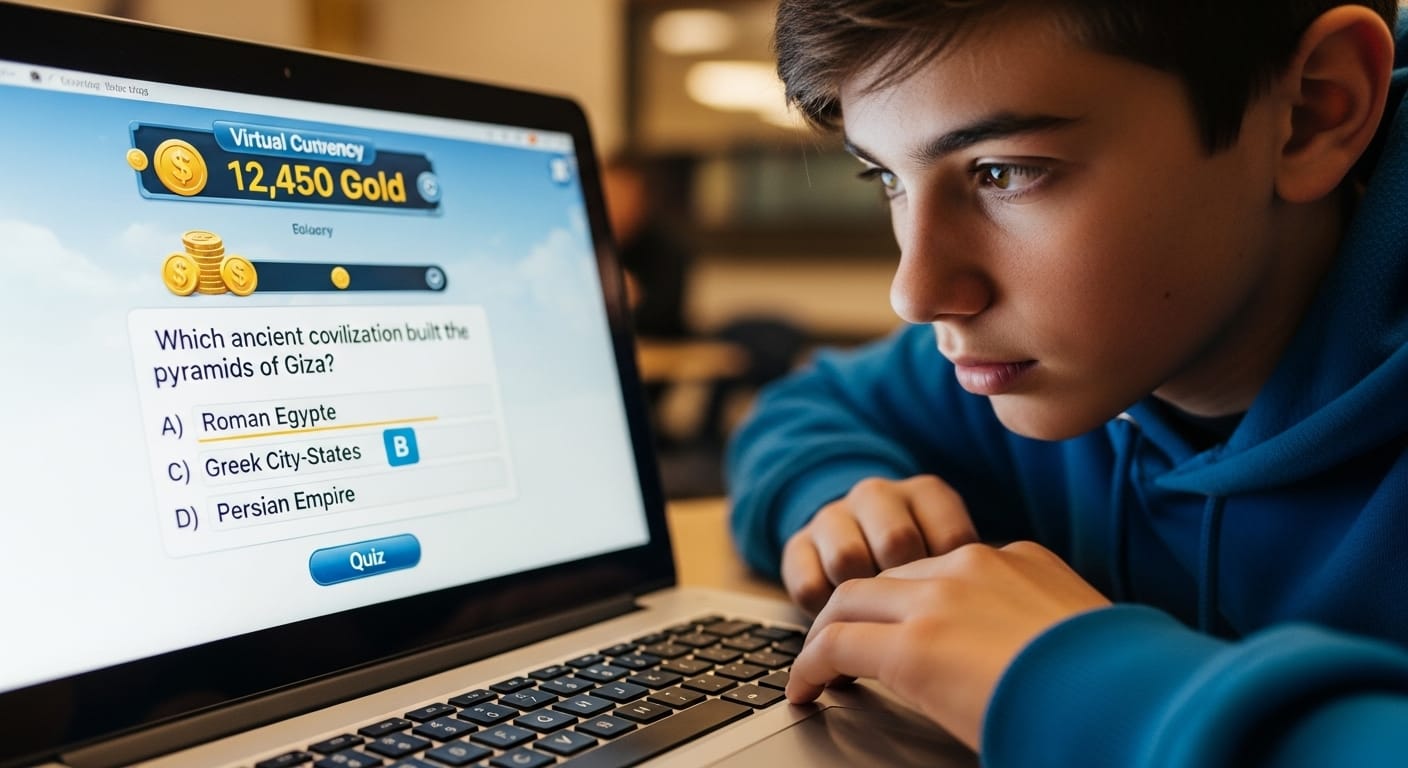

Students answer questions. They earn virtual money. They might call it “GimBucks.” This is where the magic starts.

Students answer questions. They earn virtual money. They might call it “GimBucks.” This is where the magic starts.

Earning “GimBucks”: Correct Answers as “Income”

Every right answer means more money. This is like real income.

- Like a Paycheck: Tell students that correct answers are like getting paid. They see that hard work brings money.

- Being Productive: If students answer fast and right, they earn more. This shows them how being good at something helps them earn more. For more strategies on maximizing in-game earnings, you can also look into how to get Gimkit coins efficiently.

Losing Money: Incorrect Answers as “Expenses” or “Losses”

Gimkit also takes money away for wrong answers. This teaches a lesson.

- Learning from Mistakes: Students learn that mistakes can cost money. Just like late fees do in real life.

- Handling Setbacks: It helps them think about how to get back on track. Even after a small money hit.

Strategic Spending: The Shop & Upgrades

The “Shop” in Gimkit is important. Students use their Gimkit money management skills here. They choose how to spend. Their choices matter.

The “Shop” in Gimkit is important. Students use their Gimkit money management skills here. They choose how to spend. Their choices matter.

Power-ups as Short-Term Investments/Expenses

Gimkit power-ups teach choices. They teach about money.

- Today or Tomorrow: Should a student buy a “Money Bomb” now? Or save for a “Multiplier” later? This is like choosing between fast fun and bigger gains.

- What’s Worth It?: They learn to ask: Is this item worth its cost? This is a key money question.

Multipliers & Streaks as Growth Strategies

These items in the Gimkit shop are good. They teach about money growing.

- Money Growing Big (Simple Version): A multiplier means more money for each right answer. It shows how small efforts can grow a lot over time. Even if it’s a basic idea.

- Keep Going: Streaks reward students for answering many questions in a row. It shows that steady work pays off.

Insurance & Shield Items: Relating to Risk Management and Protection

Some Gimkit games have items that protect money.

- Keeping Money Safe: Students can buy shields. These protect their money from other players. This teaches about risk assessment in money. It shows how a small cost can save them from bigger losses. For more information on managing financial risks, resources like MyMoney.gov offer valuable insights.

The Concept of “Debt” in Gimkit (Negative Balances)

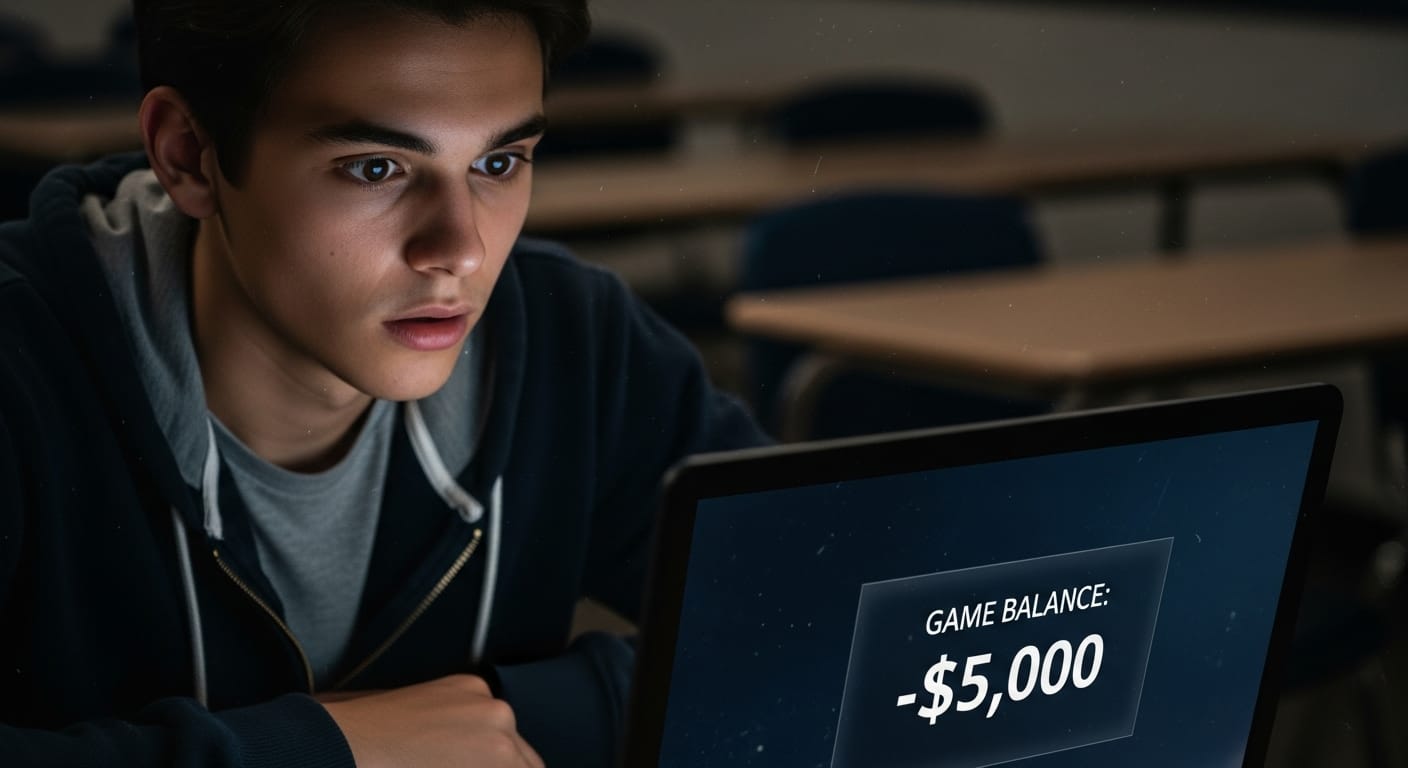

Gimkit can even show “debt.” Sometimes, money can go negative.

Gimkit can even show “debt.” Sometimes, money can go negative.

Understanding Negative Earnings: When Incorrect Answers Lead to Debt

- What Debt Feels Like: When money goes below zero, students feel the pressure. They see it stops them from buying upgrades. It stops them from winning.

- Mistakes Cost More: This shows how bad choices can make you owe money. This helps them learn about assets and liabilities.

Strategies for Recovering from Debt: Simulating Debt Repayment

- Work to Get Back: Students must answer questions right. They must pay off their negative balance first. Only then can they earn new money. This is a great way to show Gimkit debt management activities. It teaches how to get back on your feet.

Building Foundational Skills: Budgeting and Money Management with Gimkit

Let’s talk about teaching budgeting with Gimkit. We will also cover other money skills.

Core Budgeting Concepts via Gimkit Questions

Make your questions real. They should feel like money problems from life.

Make your questions real. They should feel like money problems from life.

Income vs. Expenses

- Example Questions: “You made $100 this week from babysitting. You spent $20 on a movie. How much is left?” Or “Which is a bill you pay every month: A) New shoes, B) Electric bill?”

- What Students Learn: They learn about money coming in. They learn about money going out. This means income and expenses.

Needs vs. Wants

- Example Questions: “You have $20. Do you buy A) A healthy meal, or B) A new video game? Which is a ‘need’?” Or “Which is more important: rent or a fancy coffee?”

- What Students Learn: This helps them choose what to spend on. They learn to budget smart. They learn to buy what matters most.

Saving Goals

- Example Questions: “You want to save $500 for a new bike. You save $25 a week. How many weeks until you have enough?” Or “What is the first step to save money?”

- What Students Learn: It helps them plan for their money. They learn to save for things. This is key for student financial planning. It also teaches how to teach saving with Gimkit. For more tools and guides on personal finance and saving, consider exploring resources from the National Endowment for Financial Education (NEFE).

Recommended Game Modes for Budgeting Practice

Some Gimkit game types are great for budgeting.

Some Gimkit game types are great for budgeting.

Classic Mode (Timed/Target Cash)

- How it Works: Students earn money. They spend money. They play for a set time. Or they play until they reach a monetary goal.

- Budgeting Focus: This mode is good for general Gimkit money management. Students decide. Should they buy boosts now? Or save for bigger things later? This teaches small budgets. It teaches how to use resources.

Drained

- How it Works: Players lose money all the time. They must answer questions to get money back. They must stay above zero.

- Budgeting Focus: This mode is amazing. It shows what happens with sudden costs. It makes students quickly change their spending. It is great for Gimkit debt management activities. Students fight to get their money back.

Tag/Trust No One (with custom Kit)

- How it Works: These games are for teams or single players. You can change them.

- Budgeting Focus: With your own Kit, you can make games. Students need to use their money well. They need to protect their money. Imagine needing to “buy” protection from other players. That makes protecting money a budget choice.

Kit Ideas for “Teach Budgeting with Gimkit”

Making Kits for money ideas is fun. You are the expert.

Making Kits for money ideas is fun. You are the expert.

“My Monthly Budget” Kit

- Questions: Ask about rent. Ask about bills. Ask about food. Give them a fake income.

- Scenarios: “You get $2,000 a month. Rent is $800. Food is $300. Travel is $150. How much money do you have left?” Then ask them to pick what’s most important to spend on.

“Unexpected Expenses” Kit

- Questions: Show problems. Like a broken car. Or a sudden doctor’s bill. Or a friend’s birthday party.

- Scenarios: “You planned to spend $50 on fun this month. Your dog had an emergency vet visit. It cost $100. How do you change your budget?” This shows why emergency money is needed. It shows how to be flexible with financial planning.

“Saving for a Goal” Kit

- Questions: How much money to save each week? How much each month? For a goal like a new game. Or college.

- Scenarios: “You want a new laptop. It costs $800. You have 8 months. How much money do you save each month?”

Exploring Growth & Risk: Investments and Economic Decision-Making

Students now know about budgeting. Gimkit can help them learn more. They can learn about Gimkit investment games. They can learn about bigger money ideas.

Introducing Investment Principles Through Gimkit

The Gimkit shop can teach about investing.

The Gimkit shop can teach about investing.

Understanding Risk vs. Reward

- Questions: Ask about different ways to invest. Like safe savings. Or risky stocks. “Which way of putting your money away has more risk but might make you more money: A) A savings account, B) Buying company stocks?”

- Link to Power-ups: Talk about Gimkit power-ups. Some give lots of money fast. But they cost a lot. Or they have a problem. This helps kids see risk assessment. They see that a small cost might save them from a bigger loss.

Diversification (Concepts)

- Link to Power-ups: Talk about buying different kinds of power-ups. Like speed. Or earning money. Or defense. This helps students think about spreading out their money. This makes them stronger. “If you only buy fast speed upgrades, what happens if someone attacks your money? What’s good about buying different kinds of upgrades?”

Compounding (Simple Ideas)

- How Multipliers Work: Show how multipliers work. When you buy them early, your money grows even faster. This helps students learn how interest rates can help their money grow. Especially in long Gimkit games. For more detailed explanations of investment concepts, Investopedia is an excellent external resource.

Ideal Game Modes for Investment & Economics Lessons

The “Tycoon Twists” games are gold mines. They are great for Gimkit for economics lessons. Knowing which game modes work best makes a big difference. For a full breakdown of all your options, explore Gimkit’s Game Modes.

The “Tycoon Twists” games are gold mines. They are great for Gimkit for economics lessons. Knowing which game modes work best makes a big difference. For a full breakdown of all your options, explore Gimkit’s Game Modes.

“Tycoon Twists” Modes (Farmchain, One Way Out, The Floor is Lava, Donut Dash)

- How They Work: These games are teamwork-based. They involve getting things. Making things. And spending money. All while things change.

- Economic Focus: They are like real-life economic decision-making. They show how markets change. How things run out. How to use resources. Students learn about buying and selling. They learn about making things. They learn about value. These are the best Gimkit games for high school economics.

Capture the Flag/Infection (Custom Kit)

- How they work: Players or teams fight to control things. Or to stay alive.

- Economic Focus: You can use them to teach about resources. Like one team controls the “supply” of a needed item. The other team “demands” it. Questions can be about using money smart. They can be about reaching game goals.

Kit Ideas for “Gimkit Investment Games” & Economics

Make Kits that make students think hard about money. For a deeper dive into crafting powerful learning experiences, read our tips on transforming classroom quizzes with Gimkit.

Make Kits that make students think hard about money. For a deeper dive into crafting powerful learning experiences, read our tips on transforming classroom quizzes with Gimkit.

“Market Mania” Kit

- Questions: Cover basic stock market ideas. Types of investments. What affects the economy. Or what banks do.

- Scenarios: “A company’s stock price went down. Bad news came out. Do you A) Sell it now, B) Wait, C) Buy more if you think it will get better?”

“Entrepreneurial Journey” Kit

- Questions: What if you start a business? How do you manage money coming in? How do you count money going out? Where do you put your extra money to grow the business?

- Scenarios: “You sell lemonade. Lemons and sugar cost $10. You sell 20 cups for $2 each. How much money did you make? What do you do with it: save it, spend it, or buy more lemons to make more?” This teaches about entrepreneurship. For more resources on entrepreneurship education, consider organizations like Junior Achievement.

“Economic Forces” Kit

- Questions: Ask about supply. Ask about demand. What happens when things are scarce? What about giving something up to get something else?

- Scenarios: “A popular toy is suddenly hard to find. What happens to its price? A) It goes up, B) It goes down, C) It stays the same.”

Beyond the Basics: Debt Management, Credit & Advanced Concepts

Gimkit can even teach harder ideas. Like debt. And credit.

Teaching Debt Management with Gimkit

Negative money in Gimkit is a powerful teacher. It can be hard, though.

Negative money in Gimkit is a powerful teacher. It can be hard, though.

The Impact of Negative Balances

- What Debt Does: Use games where wrong answers make money go negative. This shows how debt builds up. It shows the cost of missing payments. (They can’t earn new money until they pay off their “debt.”)

- Money Problems: Talk about how debt in Gimkit limits what they can do. Just like real debt can stop them from financial freedom.

“Debt Paydown Challenge” Kits

- Questions: Focus on ways to lower debt. Like paying the smallest debt first. Or paying the highest interest debt first.

- Scenarios: “You owe $100 in GimBucks. You have two ‘debts’: $20 at 10% interest. And $80 at 5% interest. Which one do you pay first if you want to pay less overall interest?”

Introducing Credit & Loans (Concepts)

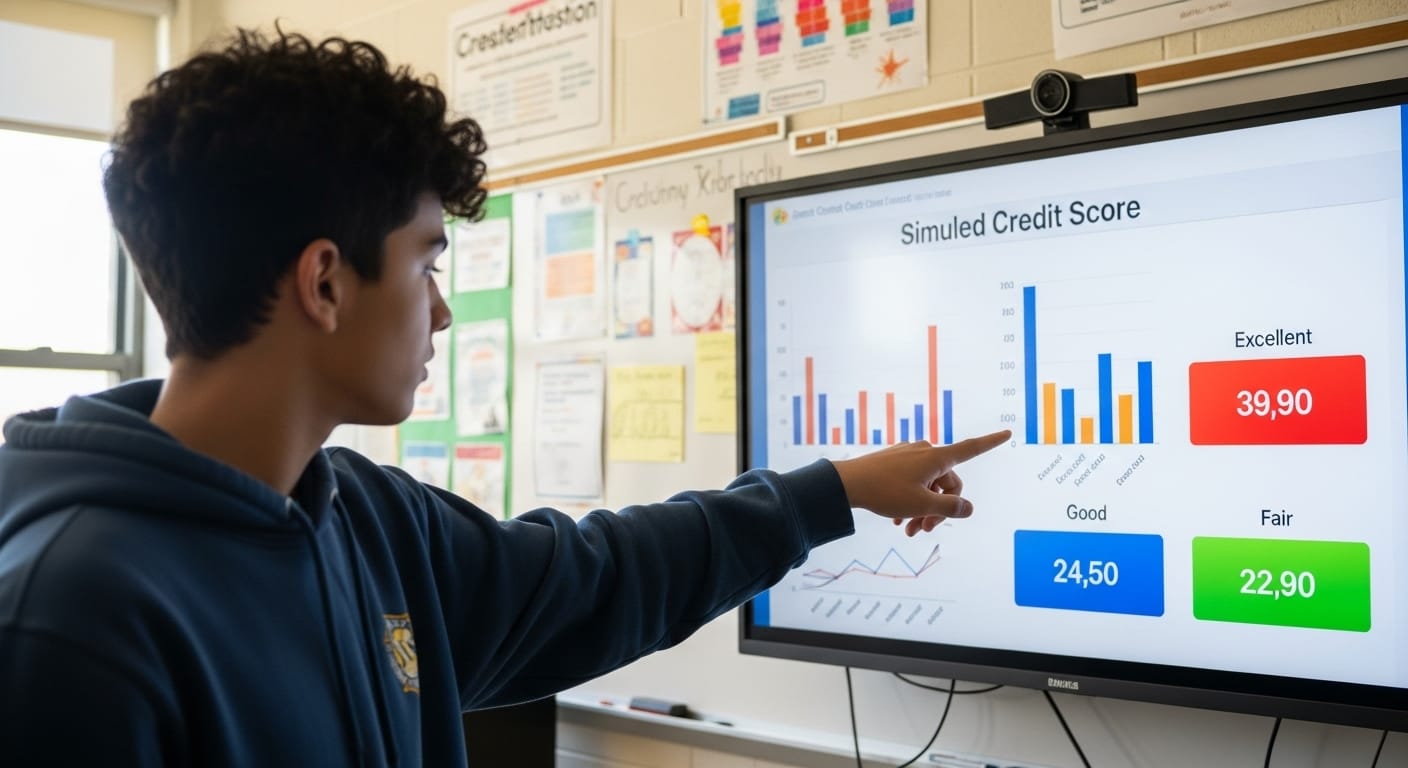

Gimkit does not have “credit scores.” But you can make connections.

Gimkit does not have “credit scores.” But you can make connections.

Questions on Credit Scores

- Make Scenarios: Ask about things that affect a “credit score.” Like paying bills on time. Or buying many things. Or borrowing too much.

- “Virtual Credit Score” Kits: Make a Kit. Right answers (or smart choices) get “credit points.” Wrong ones, lose them. This shows good versus bad credit choices. For real-world information on credit scores and their importance, resources from the Consumer Financial Protection Bureau (CFPB) are invaluable.

“Borrowing” in Gimkit

- Like Real Loans: Talk about power-ups. Some give a lot of money right away. But they have a cost. You can call this “borrowing” power. You “pay back” through correct answers. “You can get a ‘Mega Money Boost’ for $500 now. But you have to give back $600 later. Is that a good ‘loan’?”

Advanced Economic Decision-Making Scenarios

For older students, Gimkit can lead to big talks.

“Global Trade” Kits

- Questions: Ask about things coming in. Things going out. Taxes on goods. Money between countries.

- Scenarios: “Your fake country makes ‘GimFruits.’ Another country needs them. But they have high taxes on them. What should your country do?”

“Economic Policy” Scenarios

- Questions: Make Kits where students talk about fake government money choices. Like changing taxes. Or spending plans.

- Scenarios: “The ‘Gimkit Nation’ has many people out of work. Which money plan might create more jobs: A) Raise taxes, B) Lower borrowing costs, C) Spend less government money?” For more resources on economics education and policy, the Council for Economic Education (CEE) is a leading authority.

Tips for Maximizing Financial Literacy Learning with Gimkit

Using Gimkit financial literacy games well takes a few extra steps.

Align Gimkit Kits with Learning Objectives

- Specificity is Key: Ensure your questions and scenarios directly target the specific financial education curriculum standards you’re aiming to teach, whether it’s understanding assets and liabilities or the nuances of interest rates.

Debriefing is Key

- Talk About It: Always talk after games. Ask students how their game choices are like real money choices. “Why did you buy that expensive power-up? Was it a good choice? When would a real-life ‘splurge’ be smart? Or not smart?” This helps lessons stick. It makes the content timeless.

Use Real-World Scenarios in Questions

- Keep it Real: Use things students know. Like buying a car. Or saving for college. Or working a part-time job. Or planning a trip. The more real it feels, the more they learn.

Encourage Strategic Play

- Good Habits: Show that smart earning and spending helps them win. This builds good personal finance for students habits. It helps with student financial planning.

Differentiate for Age Groups

- Match the Age: Change how hard the money ideas are. For younger kids, stick to basics like earning and saving. For older kids, go deeper. Talk about Gimkit investment games. Talk about Gimkit debt management activities.

Conclusion

Gimkit is amazing. It helps students master money ideas. They learn to teach budgeting with Gimkit. They learn about Gimkit investment games. They learn Gimkit money management. Gimkit’s game money system is a powerful tool. It’s a safe place to learn about money choices. This truly links theory to practice. It is true applied learning that prepares students for life outside the classroom.

Don’t let money lessons be boring! Make your classroom a fun money playground with Gimkit. Give your students skills they need. Help them have a good money future. Imagine them talking about “how to make money grow” after a game. It’s because they felt it happen in the game. For those ready to build truly unique educational simulations, exploring Gimkit simulations opens up endless possibilities.

How do you use Gimkit to teach about money? Share your best Kit ideas. Share your strategies in the comments below! Let’s help each other. Let’s make a financially smart generation.