Forex trading can be highly profitable, but success in the market depends on knowledge, strategy, and proper risk management. With so many courses available, finding the best forex trading course can be overwhelming. The right course should provide comprehensive insights into forex markets, trading strategies, and risk management while being suitable for traders of all levels. In this guide, we will explore the key factors to consider before choosing a forex trading course.

1. Course Content and Structure

A well-structured forex trading course should cover all aspects of trading, from beginner fundamentals to advanced trading techniques. Some essential topics to look for include:

- Introduction to forex markets

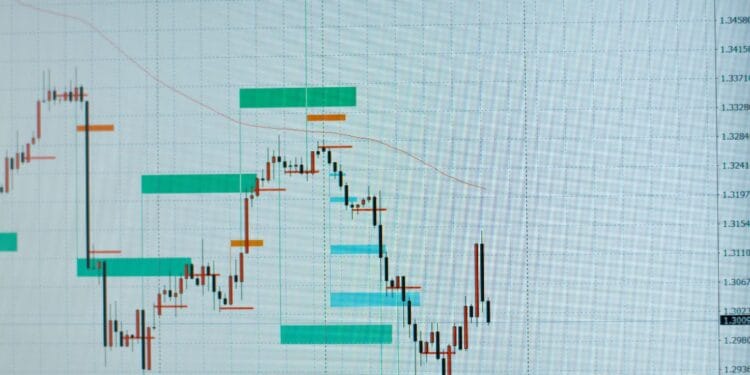

- Technical analysis and chart reading

- Fundamental analysis

- Risk management strategies

- Trading psychology and discipline

- Live market examples and case studies

A comprehensive course will offer a blend of theoretical knowledge and practical applications, helping traders build a strong foundation.

2. Credibility and Experience of the Instructor

The credibility of the instructor is a crucial factor in selecting a trading course. Look for courses taught by experienced forex traders or financial professionals with a proven track record in the industry. Consider the following when evaluating instructors:

- Years of experience in forex trading

- Their success in the market

- Reviews and testimonials from past students

- Certifications or professional qualifications

A reputable instructor will provide practical insights, realistic trading expectations, and a hands-on approach to learning.

3. Interactive Learning and Live Sessions

Forex trading is best learned through experience, making interactive learning essential. The best forex trading course should include live trading sessions, webinars, and Q&A sessions where students can interact with instructors and gain real-time market insights. Interactive courses allow traders to:

- Watch live trading strategies in action

- Receive instant feedback from instructors

- Participate in group discussions

Practical learning enhances the understanding of market movements and improves decision-making skills.

4. Accessibility and Flexibility

A good trading course should be easily accessible and flexible enough to fit different schedules. Many courses are now available online, allowing traders to learn at their own pace. Consider courses that offer:

- Video lessons and recorded webinars

- Mobile-friendly platforms

- Lifetime access to course materials

- Regular updates on market trends

Flexibility is important, especially for those who are balancing trading with other commitments.

5. Trading Strategies and Tools

Every forex trading course should teach effective trading strategies that cater to different market conditions. Look for courses that cover:

- Scalping, day trading, and swing trading techniques

- Trend following and reversal strategies

- Risk-reward ratios and stop-loss placements

- The use of indicators and trading tools

The best forex trading course will equip traders with various strategies, allowing them to adapt to different market conditions.

6. Risk Management and Capital Protection

One of the most critical aspects of forex trading is risk management. A quality trading course should emphasize:

- Position sizing and leverage control

- How to manage drawdowns effectively

- Setting stop-loss and take-profit levels

- Avoiding emotional trading decisions

Traders who understand risk management are better prepared to handle market volatility and protect their capital.

7. Support and Community Engagement

A strong support system is beneficial for forex traders, especially beginners. Many courses offer access to trading communities where students can share experiences, ask questions, and learn from others. Look for courses that provide:

- Access to a trading forum or group

- Ongoing mentorship and coaching

- Regular market analysis and updates

Being part of a trading community helps traders stay motivated and continuously improve their skills.

8. Cost vs. Value of the Course

While price is a factor, the value of a trading course should outweigh its cost. Some courses may be expensive but offer extensive resources, live mentorship, and trading tools. Before enrolling, consider:

- Whether the course provides free trial options or money-back guarantees

- Additional resources such as eBooks, market updates, and mentorship

- The overall return on investment (ROI) in terms of knowledge gained

Spending money on a valuable course is an investment in one’s trading future.

9. Demo Accounts and Practical Experience

A hands-on approach is essential for learning forex trading. The best forex trading course should encourage students to practice with demo accounts before moving to live trading. Practical experience helps traders:

- Apply learned strategies in real market conditions

- Develop confidence and discipline

- Test different trading techniques without financial risk

A course that integrates demo trading ensures that students are well-prepared before entering the live markets.

Conclusion

Choosing the best forex trading course is an important step in a trader’s journey. A well-rounded course should offer comprehensive content, experienced instructors, interactive learning, and strong community support. Additionally, practical experience through demo trading and an emphasis on risk management are essential for long-term success in the forex market. By considering these key factors, traders can make informed decisions and set themselves up for a profitable trading career.